wv estate tax return

A return or extension may be submitted without payment if the estate does not owe any tax. For other forms in the Form 706 series and for Forms 8892 and 8855 see the related.

Wv Tax Forms Fill Out And Sign Printable Pdf Template Signnow

Fill-In or Print.

. In addition to the individual tax return and the estate income tax return it may also be necessary for an executor to file a US Estate Tax Return Form 706. For further information concerning federal estate tax requirements contact the Internal Revenue Service at 1-800-829-1 040. 304 523-2100 Huntington WV 304 521-6120 Clarksburg WV.

And like every US. I The Internal evenue Service requires the filing of a r Federal Estate Tax return Form 706 for the estate of every citizen of the united States whose gross estate at the time of death was larger than the amount of the federal exemption equivalent. The exemption equivalents are.

If applicable include an estimated tax payment. For decedents dying July 13 2001 and after a release or certificate of non-liability from the West Virginia State Tax Department. Log in to your account.

The IT-101A is now a combined form. Any estate which is required to file a Federal Estate Tax Return will also be required to file a West Virginia Estate Tax Return. West Virginia State Tax Department Tax Account Administration Division PO.

Address to which he would return if released from the care facility. The exemption equivalents are. Due date to file 2021 tax returns with approved extension.

Sarah FisherFeb 24 2020. -- The personal representative of every estate subject to the tax imposed by this article who is required by the laws of the United States to file a federal estate tax return shall file with the Tax. Go to the Chrome Web Store and add the signNow extension to your browser.

Open the email you received with the documents that need signing. Below are five simple steps to get your wv state tax department fiduciary estate tax return forms 2008 eSigned without leaving your Gmail account. This final estate tax return is necessary only when an estate is large enough-at least 114 million in assets as of 2019-to require payment of estate taxes related to the.

13 rows West Virginia wont tax your estate but the federal government may if your estate has. A Confidential Tax Information Authorization CTIA form is included with the paper. Select Popular Legal Forms Packages of Any Category.

Let Anna M. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map. For tax year 2021 the due date for an annual Estate or Trust West Virginia Fiduciary Income Tax return is April 18 2022.

Only estates subject to the tax imposed by West Virginia Code 11-11-3 will be issued a release of lien pursuant to West Virginia Code 11-11-17. In accordance with WV Code Fiduciary Commissioners. Although West Virginia has neither an estate tax or nor an inheritance tax the federal estate tax may still apply depending on the value of the estate.

In addition to the individual tax return and the estate income tax return it may also be necessary for an executor to file a us estate tax return form 706. Any estate required to file a Federal Estate Tax Return Form 706 will be required to file a West Virginia Estate Tax Return. Access IRS Tax Forms.

Find pros you can trust and read reviews to compare. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. A return or extension submitted without payment is still due nine months after the decedents date of death.

The proper forms and instructions will be sent to the fiduciary once the appraisement has been received by the State Tax Department. Prices to suit all budgets. The Department of Revenue administers and enforces West Virginia revenue laws including the regulation of insurance banking and gaming industries as well as.

The proper forms and instructions will be sent to the ExecutorAdministrator after the appraisement has been filed. West Virginia begins 2022 tax season. Ad The Leading Online Publisher of National and State-specific Probate Legal Documents.

West Virginia State Tax Department will begin accepting individual 2021 tax returns on this date. IT-101A Employers Annual Return of Income Tax Withheld. The Internal Revenue Service requires the filing of a Federal Estate Tax Return Form 706 for the estate of every citizen of the United States whose gross estate at the time of death was larger than the amount of the federal exemption equivalent.

Report Tax Fraud Join the Tax Commissioners Office Mailing List Tax Information and Assistance. Price an experienced estate planning attorney answer your questions about West Virginia inheritance tax and other taxes that might apply to your estate or inheritance. Ad Real prices from local pros for any project.

Payment of any tax balance due may be made by completing the voucher below detaching and mailing to. An executor or a preparer may request an extension for filing the estate tax return by completing the form above. Complete Edit or Print Tax Forms Instantly.

For tax year 2021 the due date for an annual Estate or Trust West Virginia Fiduciary Income Tax return is April 18 2022. Application for Extension of Time to File a Washington State Estate and Transfer Tax Return. IT-1001-A Employers Withholding Tax Tables.

-- No West Virginia estate tax return needs to be filed if the estate of the decedent is not subject to the tax imposed by this article. The taxable year of the estate or trust for west virginia income tax purposes is the same as the one used for federal tax purposes. Box 2585 Charleston.

Due date to file 2021 tax return request an extension and pay tax owed. Washington estate tax forms and estate tax payment. See reviews photos directions phone numbers and more for Wv State Tax Return locations in Tornado WV.

Well break down these inheritance laws including what happens if you die without a valid will and. Address to which he would return if released from the care facility. HOW AND WHERE TO FILE.

Generally virginia does not require an estate tax return unless there is a federal estate tax return due. The gift tax return is due on April 15th following the year in which the gift is made. All Major Categories Covered.

State West Virginia has its own unique set of laws governing inheritance. Tax Return will also be required to file a West Virginia Estate Tax Return. The taxable year of the estate or trust for West Virginia income tax purposes is the same as the one used for federal tax purposes.

Available for pc ios and android. Payment of Additional Estate Taxes in WV. IT-101V Employers West Virginia Income Tax Withheld.

No separate reconciliation is required IT-101Q Employers Quarterly Return of Income Tax Withheld - Form and Instructions. A request for an extension to file the Washington estate tax return and an estimated payment. Before filing form 1041 you will need to obtain a tax.

Nor is there a West Virginia estate tax which again would be charged to the. 31 rows Generally the estate tax return is due nine months after the date of death. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date.

B Returns by personal representative.

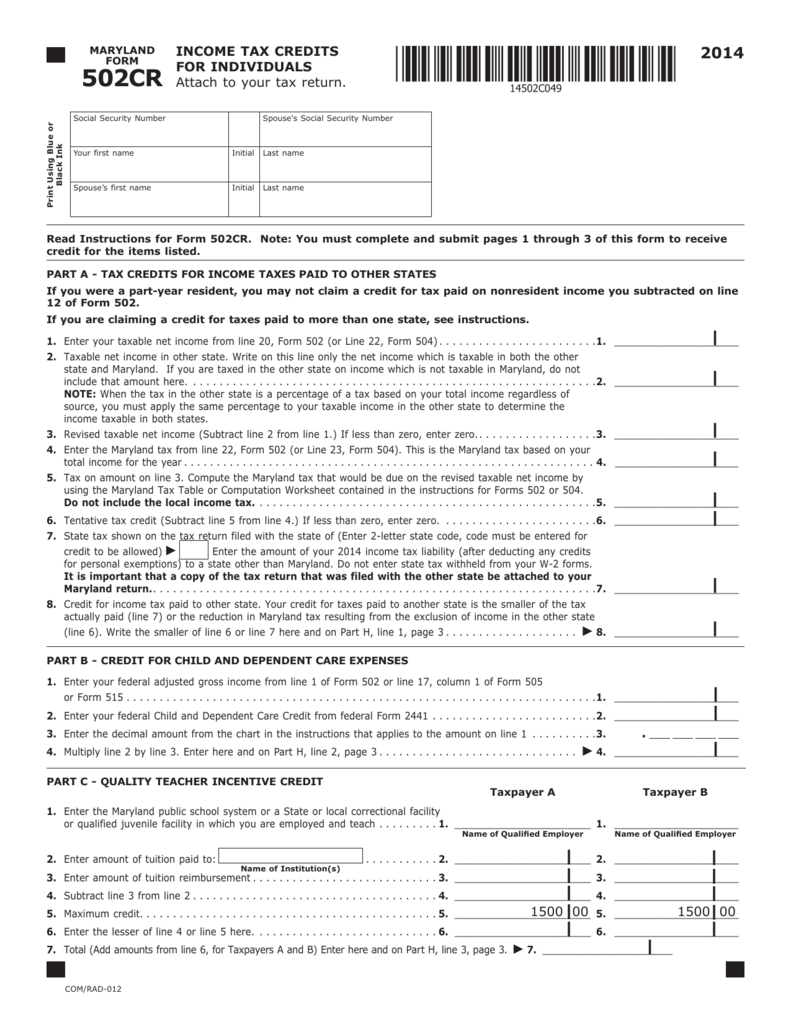

502cr Maryland Tax Forms And Instructions

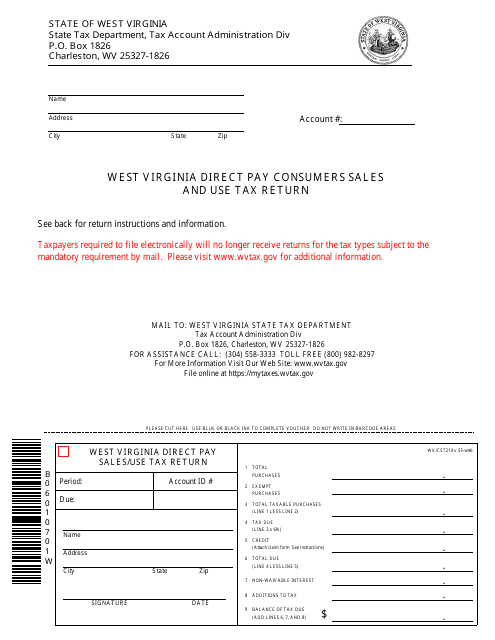

Form Wv Cst 210 Download Printable Pdf Or Fill Online West Virginia Direct Pay Consumers Sales And Use Tax Return West Virginia Templateroller

Will The Irs Extend The Tax Deadline In 2022 Marca

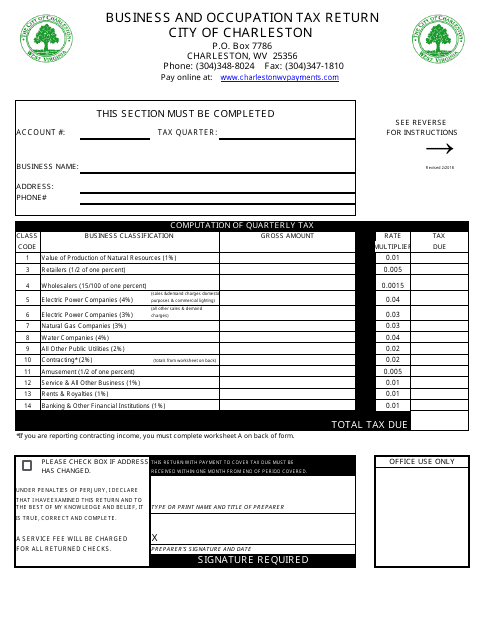

West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller

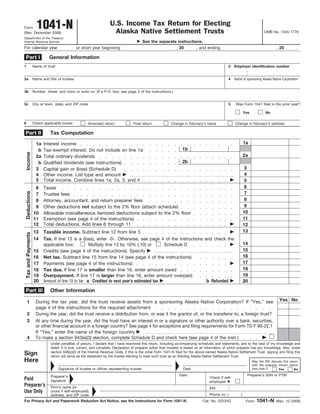

Form 1041 N U S Income Tax Return For Electing Alaska Native Settle

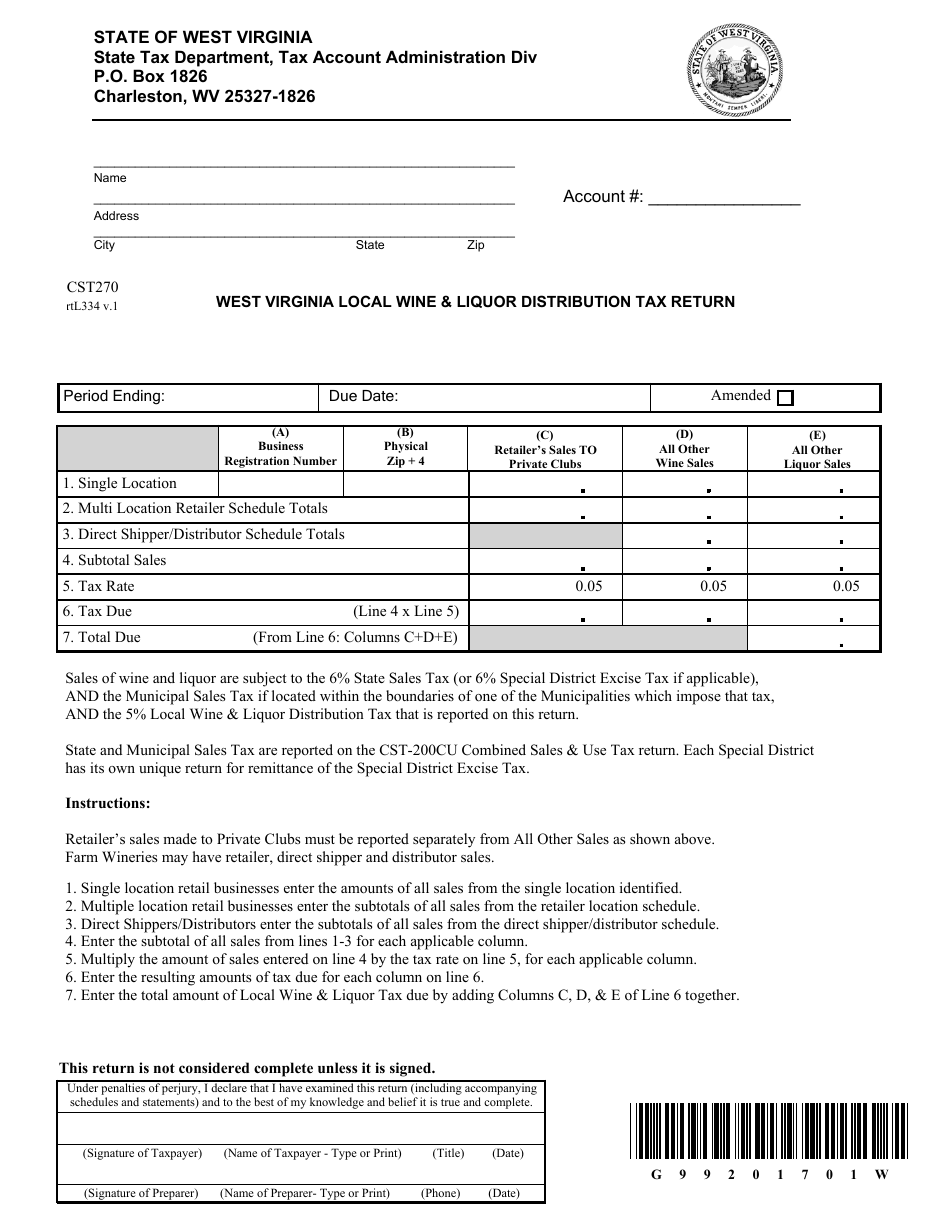

Form Cst 270 Download Printable Pdf Or Fill Online Local Wine Liquor Distribution Tax Return West Virginia Templateroller

Wv Tax Deadline Extended To May 17 Wowk 13 News

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Form Wv Bot 301 Download Printable Pdf Or Fill Online Annual Business Occupation Tax Return For Utilities West Virginia Templateroller

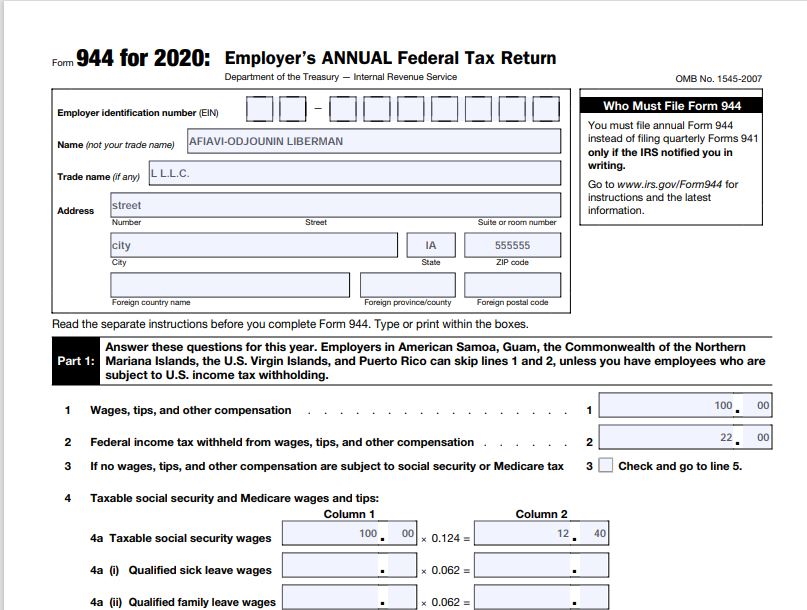

2020 Federal Tax Forms And Instructions Nina S Soap

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

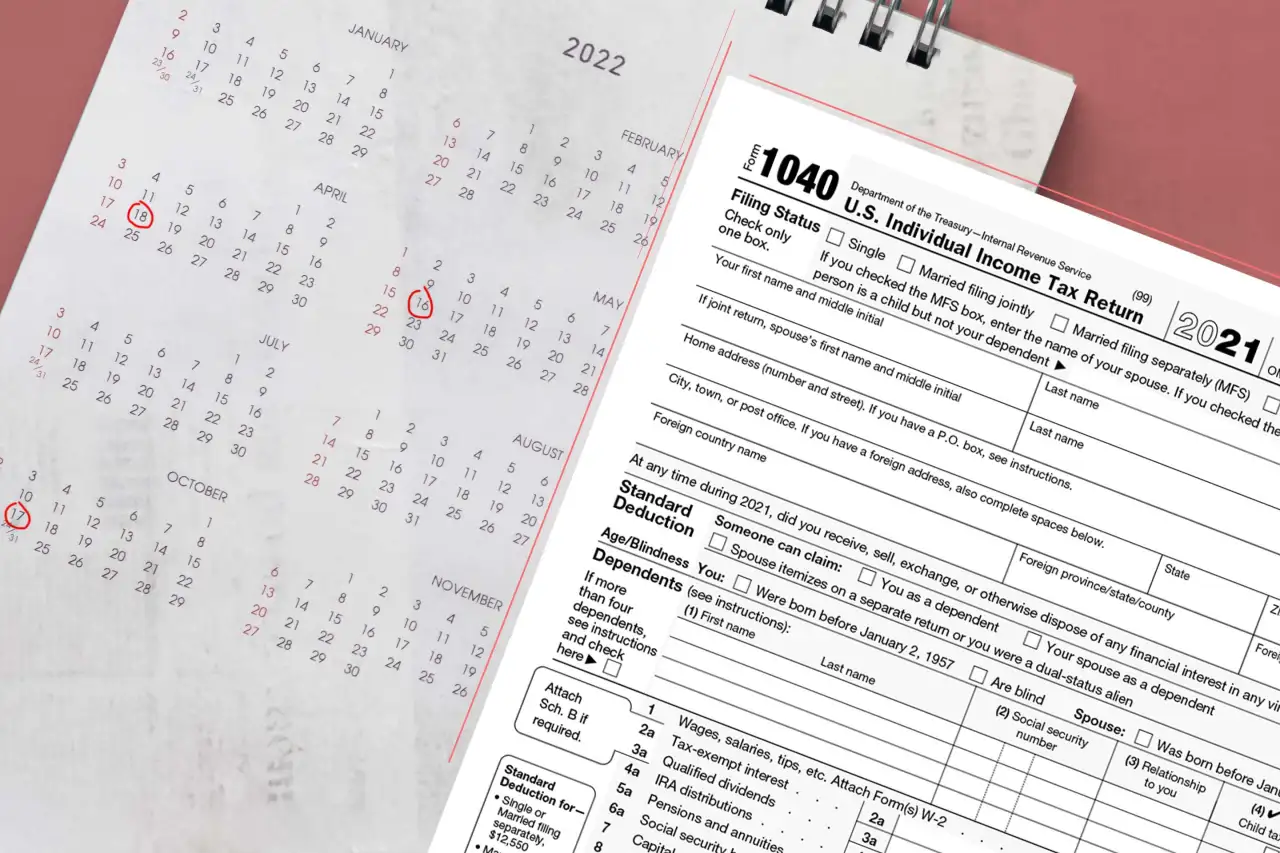

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

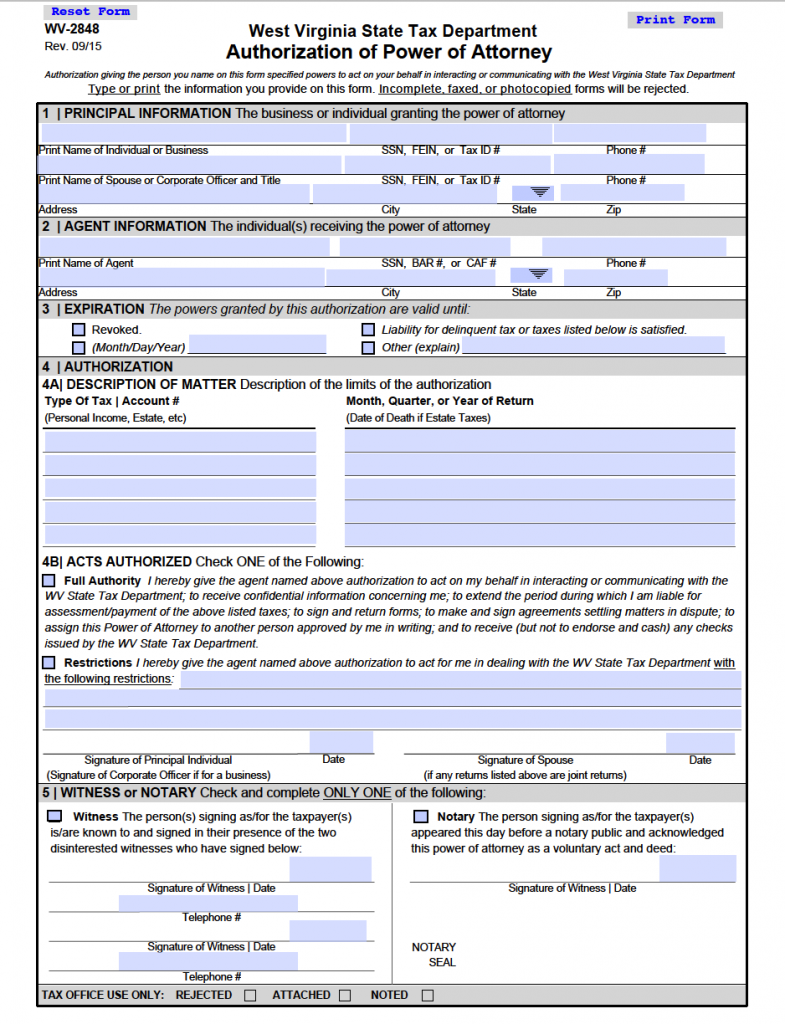

Free Tax Power Of Attorney West Virginia Form Adobe Pdf

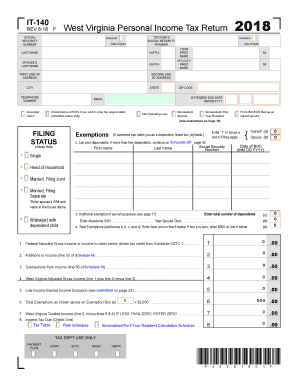

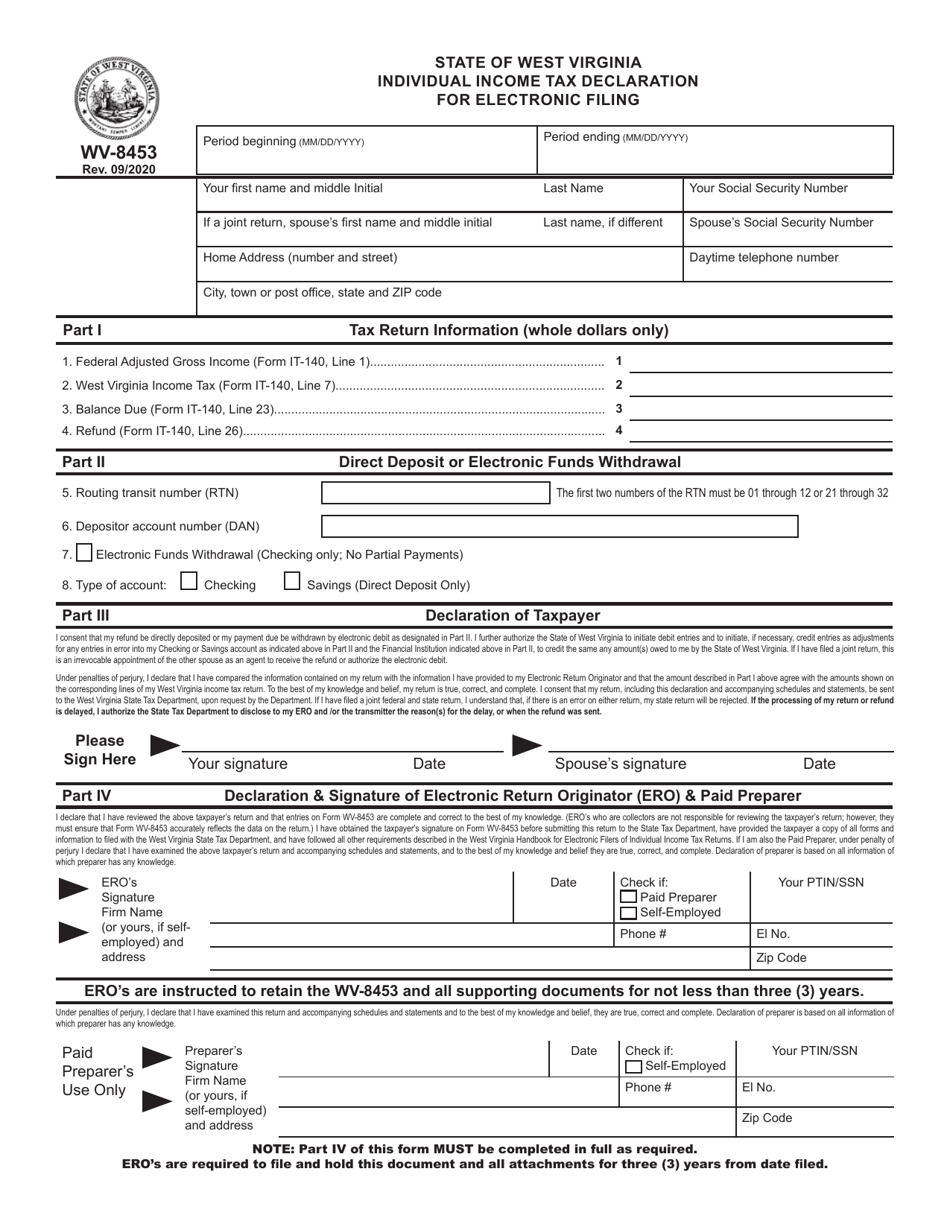

West Virginia Tax Forms And Instructions For 2021 Form It 140

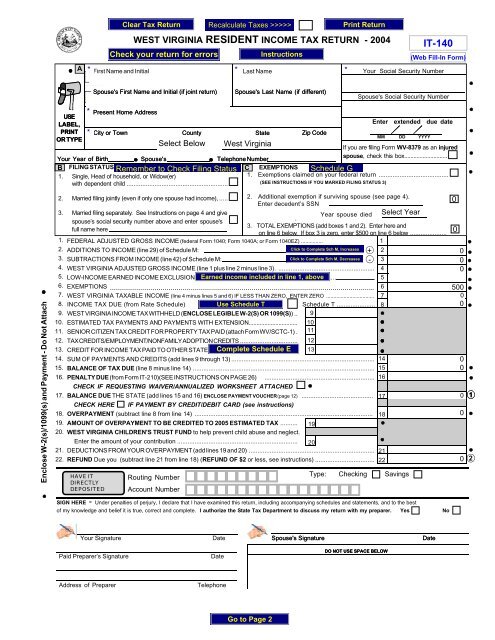

It 150 Resident Income Tax Return Short Form And Instructions

Form 1041 U S Income Tax Return For Estates And Trusts Form 1041

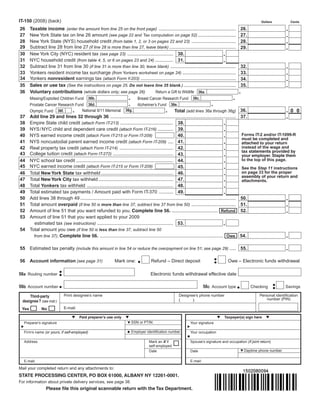

Form Wv 8453 Download Printable Pdf Or Fill Online Individual Income Tax Declaration For Electronic Filing West Virginia Templateroller

Form Wv It 140 State Of West Virginia

Estate Taxes In Wv Filing A Final Estate Tax Return And Other Responsibilities Blog Jenkins Fenstermaker Pllc